how to lower property taxes in pa

28 Key Pros Cons Of Property Taxes E C Property Tax Appeal Tips To Reduce Your Property Tax Bill Property Tax Appeals When How Why To Submit Plus A Sample Letter State Local Property Tax Collections Per Capita Tax Foundation. A portion of your Pennsylvania homes.

Great Experience As Always Job Reviewed Flyer Professional Web Design Flyer Design

For homeowners theres no way to get out of paying property taxes.

. Special Session Act 1 of 2006 the Taxpayer Relief Act was signed on June 27 2006 and modified in June 2011 by Act 25 of 2011This law eases the financial burden of home ownership by providing school districts the means to lower property taxes to homeowners especially senior citizens via the funding provided by gaming revenue. Checking out the tax bill itself can be an easy way to lower your property taxes. Check Your Tax Bill For Inaccuracies.

PHILADELPHIA CBS The advent of casino gambling in Pennsylvania was supposed to help homeowners in the form of lower property tax bills. Credit is available to lower income families and individuals receiving Tax Forgiveness. According to the PA Department of Educations website the Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was created to provide property tax reduction allocations to be distributed by the Commonwealth to each school district.

Monday - Friday from 800 AM to 430 PM. If you think you might be paying too much in real estate taxes you can start the appeal. If you own your home your annual income cannot be more than 35000.

WHTM New legislation proposed in Pennsylvania would eliminate school property taxes and establish a more. Basically your propertys assessed value is reduced through this Act and since property tax is based on assessed value the tax is. Credit against Pennsylvania income tax is allowed for gross or net income taxes paid by Pennsylvania residents to other states.

2 South Second Street. Property taxes are quite possibly the most widely unpopular taxes in. PA Property Tax Relief for SeniorsProperty TaxRent Rebate Program.

The primary goal of the Clean and Green program is to encourage landowners to preserve agricultural land by providing tax savings for preservation. You can try out some of the following strategies. If you rent a property your.

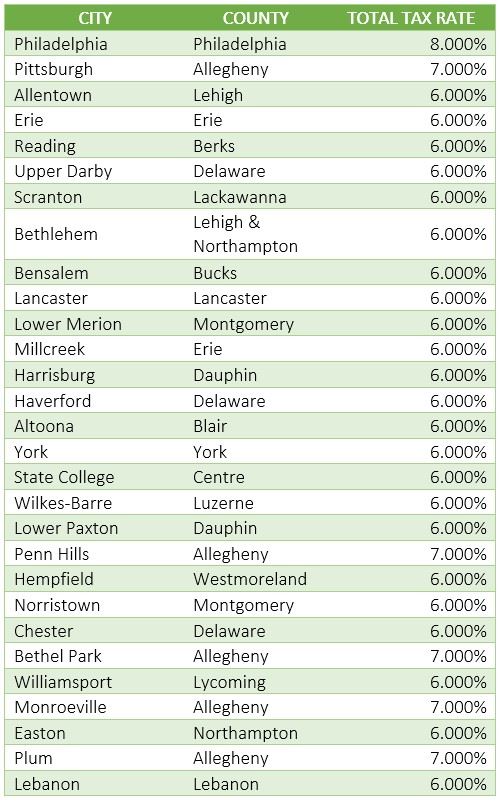

For instance if your home was previously assessed at 260000 but the current market value is 225000 you might qualify for lower taxes due to the change in value. Effective property tax rates on a county basis range from 091 to 246. Overall Pennsylvania has property tax rates that are higher than national averages.

This publication describes the Clean and Green programs requirements. In fact the state carries a 150 average effective property tax rate in comparison to the 107 national average. The county tax assessor has placed a taxable value of 400000 on the property.

In case you are a senior citizen living in Pennsylvania you should know that you may be eligible for a rebate on your property taxes or rent. To qualify for this program you need to fulfill some requirements. Property taxes in Pennsylvania are paid to counties boroughs and townships and school districts not the state itself.

This means that their annual property tax is 4000. With that in hand check out the details of your tax bill. How to lower property taxes in pa Sunday February 27 2022 Edit.

Beyond attempting to reduce the taxable value of your home Pennsylvania allows for reduced property taxes if the homeowner meets certain requirements. Many of these programs were clarified and expanded through the Homeowner Tax Relief Act Act 72 of 2004. There are two parts to your tax bill.

House Bill 2500 would allow for special tax provisions for longtime owner-occupants where property values have risen due to other deteriorating properties being improved or new construction occurring. An effective way of saving property taxes in Pennsylvania is to enroll farmland or forest land in the Clean and Green program. After researching recent sales of comparable homes Larry and Joan d conclude that the taxable value of their home should be 350000.

Postpone home improvements until after the assessment Check if your tax bill has inaccuracies and request reassessment if necessary. Chester County collects the highest property tax in Pennsylvania levying an average of 419200 125 of median home value yearly in property taxes while Forest County has the lowest property tax in the state collecting an average tax of 86000 108 of median home value. Years later however some homeowners say theyve.

Home Services Property Taxes. The assessed value of your homeproperty and the actual tax rates applied. Dauphin County Administration Building - 2nd Floor.

Tax credit programs also reduce income tax liability for qualified applicants. The local tax rate is 10 for every 1000 of taxable value. Overview of Pennsylvania Taxes.

They successfully appeal their assessment. You can likely obtain a free copy of your property tax bill from the local government offices. Two of the most commonly used programs are.

The exact property tax levied depends on the county in Pennsylvania the property is located in. Depending on when your home was last assessed your taxes may or may not be accurate. While you cant do anything about the tax rates of.

Even if you dont qualify for PA senior citizen property tax rebate you might be eligible to reduce your property tax bill in some other way. But there are a few ways to reduce themyou just have to know how and where to start. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own.

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

What Are Tax Directives Moneytoday Tax Reduction Tax Types Of Taxes

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

.jpg)

Pa State Rep Property Taxes Time To Eliminate

Getting Ready To Sell A Property In Pennsylvania Call Jennifer 717 723 9080 The Sellers Property Disclosure I Real Estate Forms Real Estate License Tenants

What Is Act 1 And How Did It Impact Property Taxes And School Funding Whyy

The Pa Consumer Notice Information Can Be Found Here When You Re Ready To Sell Or Buy Call 717 723 9080 Real Estate Forms Being A Landlord Consumers

Pennsylvania Property Tax H R Block

Hot Off The Internet Free Copy Enviropolitics May 5 2020 Green Power Event Calendar May

File A Principal Residence Exemption Pre To Save 900 Per Year On A 100k Property It Only Takes 5 Minutes To D Home Buying Homeowners Insurance Real Estate

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Pennsylvania Legal Aid Network

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pennsylvania Sales Tax Guide For Businesses

Enjoy A Luxury Home At The Charming Hatboro Station Community In Hatboro Pa Luxury Homes Home Builders Home